Getting a loan without a payslip is like buying an iPhone without paying the vendor. A loan provider demands proof of income after your initial application. He requests that you analyse your affordability to borrow a particular amount. It helps him determine whether you can afford to repay the loan in timely instalments.

It is a legal and important process that any loan application involves. In the absence of this, customers and loan providers may suffer financially. Therefore, it is mandatory to prove affordability regardless of the loan company you choose. You cannot skip the basic credit and financial assessment process.

However, some individuals lack pay slips. It could be someone earning as a self-employed freelancer or receiving a salary in cash. In that case, it is challenging to prove the earnings. Well, it does not cancel you out from getting a loan. Read ahead to know more.

Does 24loanswales offer loans without pay slips?

Yes, you may get a loan even if you don’t receive a pay slip for your income. The company prioritises the individual’s comfort and ease while lending. Hence, it streamlines the deal for you by offering alternative options to prove your income.

The best part is – you don’t need to make an effort for this. You can get the loan by providing any basic proof of your earnings. It is not necessary to provide a pay slip if you don’t receive one. Thus, anyone with a part-time, self-employed, or other legal income may qualify.

How can I get a loan without a specific salary slip? Explain with an example.

Here is a basic example of how you can get an unsecured loan with bad credit without income proof. You may find it relatable and get answers to your questions or curiosity. Below is the basic structure of a query that we received for an unsecured loan. Let’s analyse the case.

- Name- Stuart Briggs

- Income- £10000/year

- Designation- digital marketer

- Loan amount requirement- £5000

- Credit score- 500 (bad credit score)

- Source of income- Contract-based projects

Overview

So, Stuart Briggs (aged 25) contacted us for an unsecured loan to repair the house’s entrance door. He receives contractual income from a part-time working source. However, he was dealing with debts like payday loans, car loans, student loans, and credit cards.

Seasonal income and inaccurate salary frequency affect the timely payments. It led to a bad credit history and affected the credit score. However, he was still optimistic about getting better interest rates.

Problem & Analysis

The primary problem was- no valid salary proof. Now, that’s something to think about. He worked as a contractual worker and thus lacked a salary slip. We analyse the financial situation by checking the credit report.

It helps us identify the income modes, employment history and the bank account attached to salary. The tasks just got easy for us. Thus, we knew that now he does not need to worry about not having valid income proof.

Solution

We quickly checked the bank account where he received his recent salary. Thus, asked for bank statements that reveal the particular amount he receives periodically. Accordingly, we invested our expertise in determining the affordability.

We put his approximate earnings against the monthly expenses, which were obviously high. Accordingly, we suggested he either fetch a reduced amount or provide additional earning proof. He agreed to the former, and hence, we happily approved the loan.

Suggestions we offer to the client

Well, he did not have any income proof now, but he got lucky with us. However, in general, hosting valid proof of earnings is crucial. In this situation, he can:

- Use only one account with direct debit to receive salary

- Keep track of the days he receives salary- it becomes scannable

- Try to get a receipt or payment receivables from the client as proof of your services

- Ask the contractual company to provide some income proof

Thus, we provide the needed expertise to individuals with serious financial conditions. You may even get a bad credit loan at low interest rates. We personalise the deal with the best of our experience and knowledge.

So, can you get a loan without a salary slip?

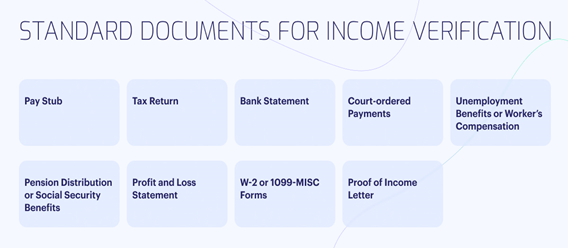

Yes, with us, you can get a loan without a salary slip requirement. The facility is for those individuals who work but lack specific proof to reveal their income. Here is how you can prove your income, depending on your designation and the income type.

- Bank statements for the last months

It is one of the best ways to provide your income proof. Keep bank statements of at least the past 6 months ready before applying. If seeking a guarantor or co-signer-based loan, you must provide the person’s statements, too.

- Individuals who receive wages

The condition may differ here as wages are usually paid weekly or daily. Thus, the amount you may get depends on the total you earn in a month. Accordingly, you may provide proof of your weekly, monthly, and fortnightly pay slips.

It is an ideal arrangement if you need unsecured loans with no credit check facility. In this, you get a small amount without detailed credit screening. It is usually ideal for emergency cash needs and same-day loan approvals.

- Individuals receiving benefits and tax credits

It is generally ideal for self-employed individuals seeking unsecured loans for immediate or medium-term requirements. Usually, you file a self-assessment every year. Thus, you must reveal the latest report to get the loan. It is apart from the basic income proof in the form of invoices.

However, if the customer delays paying the dues, you can present a self-assessment as proof to get a small loan. Alternatively, you must reveal the tax credits that you leverage as a lump sum post-filing self-assessment.

It also improves your loan affordability, and you may qualify for a high amount. You must also provide recent bank statements or a cash book. If you lack clarity on monthly earnings, contact your accountant. He will provide clear proof of the money you earned last month. You can use it as a base to get a loan.

Bottom line

Yes, it is possible to get a loan even if you don’t have a salary slip. Different loan providers may have a unique take towards this. Thus, you must be ready for the surprise. You can also prepare early by having a tab on the relevant bank account, bank statements, tax assessments and receipt of part-time payments. It prevents you from facing loan rejections at the most crucial moments. For more information, you can contact us.

When someone writes about UK finance, both research and experience should be visible. Ken Stokes is a prime example of this. He is a well-experienced finance writer and author and possesses years of experience. He is currently responsible for the position of Senior Loan Executive at 24loanswales. He joined the organisation 6 months ago, but he already has enough experience to guide someone on any loan product.Ken Stokes is a PhD holder in the Business Finance stream. Therefore, he has extensive knowledge of the UK finance sector.

Being part of 24loanswales, he has already written research-based blogs for the company’s website. Start reading his blogs here before applying for any loan.